Bitcoin Price Prediction 2025-2040: Analyzing the Next Bull Cycle

#BTC

- Technical Outlook: MACD bullish divergence suggests accumulation phase

- Market Sentiment: Whale activity offsets short-term ETF volatility

- Adoption Drivers: Lightning Network expansion accelerates mainstream use

BTC Price Prediction

BTC Technical Analysis: Key Indicators Point to Potential Rebound

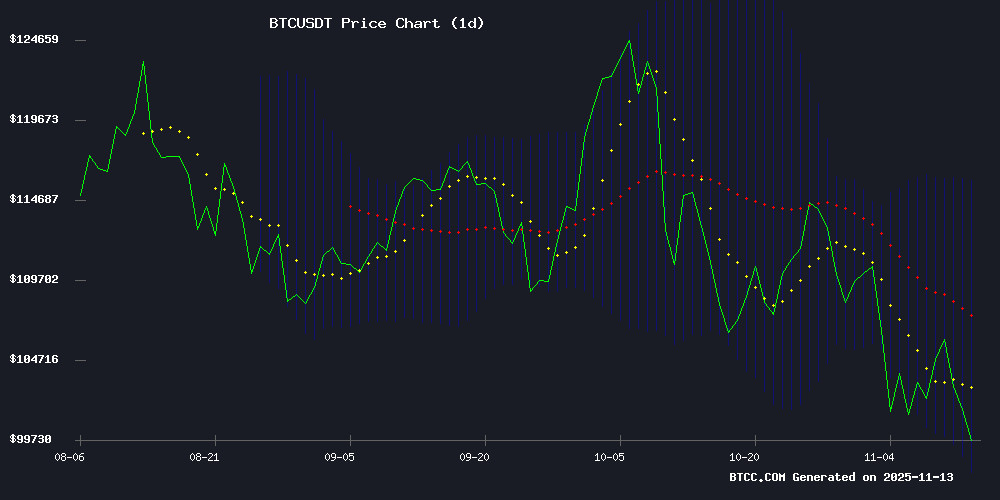

BTCC financial analyst Sophia notes that Bitcoin is currently trading at $100,969, below its 20-day moving average of $106,858. The MACD indicator shows bullish momentum with a positive histogram (1119.46), suggesting potential upward movement. Bollinger Bands indicate BTC is trading near the lower band ($97,940), which often precedes mean reversion toward the middle band ($106,858).

Market Sentiment: Whales Accumulate Amid Macro Uncertainty

Sophia observes mixed signals from recent developments: While whale accumulation and institutional ETF flows suggest confidence, macroeconomic concerns and profit-taking warnings create headwinds. The expansion of Lightning Network accessibility (58M new users) and academic adoption (Hesperides University's bitcoin Master's program) provide long-term bullish fundamentals.

Factors Influencing BTC's Price

Bitcoin Whales Accumulate as BTC Defends $100K Threshold

Bitcoin's $100,000 level has become a battleground for market sentiment. On-chain data reveals whales are aggressively accumulating BTC each time the price approaches this psychological threshold, signaling institutional conviction in the bull market's longevity.

The cryptocurrency gained 0.9% to $102,500 following resolution of the U.S. government shutdown, though broader market sentiment remains fragile. The Fear and Greed Index plunged to 25 from 62 just two months prior, reflecting tariff tensions and Fed Chair Powell's hawkish rate comments.

Such volatility during accumulation phases often precedes explosive moves. Market participants now watch whether Bitcoin can consolidate above $100,000 - a level that triggered panic selling when briefly breached last week, but now appears to have strong defensive support.

Bitcoin ETF Flows Reflect Market Jitters Ahead of Inflation Data

Spot Bitcoin ETFs experienced a rollercoaster week, with $524 million in inflows on Nov. 11 followed by $278 million in outflows the next day. The volatility underscores traders' sensitivity to macroeconomic signals, particularly long-term Treasury yields and CPI data.

Bitcoin's price action mirrored this uncertainty, dipping toward $100,000 before stabilizing in a tight range below its October peak near $126,000. ETF flows and price movements appear directly correlated with shifts in real yields and debt supply concerns.

The market's tentative response to Treasury auction adjustments suggests institutional players remain cautious. 'When the tide of liquidity turns, even crypto feels the pull,' observed one desk trader, capturing the sector's growing integration with traditional finance.

Bitcoin Price Volatility Amid Whale Accumulation and ETF Resurgence

Bitcoin's price retreated to $102,000 after briefly touching $105,000, marking a 3% decline as U.S. markets opened. The pullback follows a period of heightened volatility across crypto markets, with major altcoins mirroring BTC's downward trajectory.

Whale wallets accumulated 45,000 BTC last week - the second-largest weekly purchase this year. This mirrors March's accumulation pattern when institutional investors capitalized on price dips. Exchange outflows suggest whales are moving holdings to cold storage, signaling long-term conviction despite recent price weakness.

Spot Bitcoin ETFs recorded $524 million in net inflows, their strongest day in a month. The resurgence of institutional demand contrasts with corporate treasury diversification, as some firms reduce BTC allocations to 60% while expanding overall crypto exposure.

Bitcoin (BTC) Surge Predicted: Analysts See 33.98% Rebound Despite Short-Term Fear

Bitcoin's price dipped 3.01% today, underperforming against the broader crypto market. Yet, the asset remains resilient—up 17.34% year-over-year—as analysts forecast a 33.98% rally by November 17, 2025.

The world's largest cryptocurrency trades at $103,286, mirroring a 1.25% decline in total market capitalization. Despite a 10.45% monthly drop, BTC holds $17,034 above its year-ago price of $88,023. Volatility has subdued to 3.54% over the past month, with 16 green days suggesting underlying strength.

October 2025's all-time high of $126,025 now seems distant, but the current cycle shows a $107,291 peak and $99,013 trough. 'Short-term bearishness masks structural bullishness,' one trader noted, pointing to compressed volatility as a coiled spring.

Taiwan Explores National Bitcoin Reserve Strategy Inspired by US Model

Taiwan's government has initiated a formal study on incorporating Bitcoin into its national reserves, with Prime Minister Zhuo Rongtai announcing a comprehensive report due by end-2025. The assessment focuses on confiscated BTC holdings seized in legal cases, mirroring the US Treasury's approach established earlier this year.

Central Bank Governor Yang Chin-long will co-lead the evaluation of operational frameworks and risk parameters. This marks Taiwan's first official foray into sovereign cryptocurrency asset management, potentially reshaping its $600 billion foreign reserves portfolio.

Legislative urgency surrounds the initiative, with parliamentarians advocating accelerated crypto regulation to capitalize on Bitcoin's growing institutional adoption. The move signals strategic positioning amid geopolitical tensions, potentially using cryptocurrency reserves as an economic sovereignty tool.

Cash App Expands Bitcoin Accessibility to 58 Million Users with Lightning Network Integration

Cash App has rolled out instant Bitcoin payments for its 58 million monthly users, leveraging USD balances to facilitate seamless BTC transactions. The feature automatically converts USD to bitcoin at the point of sale, eliminating taxable events and preserving users' crypto holdings. Merchants benefit from fee-free settlements and reduced chargeback risks through Square's infrastructure.

A new Bitcoin Map functionality pinpoints Lightning Network-enabled businesses, while stablecoin transfers and Auto Invest enhancements further solidify Cash App's crypto offerings. The move marks a significant step toward mainstream Bitcoin adoption, particularly for cross-border payments via Lightning's rapid settlement rails.

Bitcoin Volatility Intensifies Amid Macroeconomic Uncertainty

Bitcoin plunged to $100,800 during US trading hours on November 12, wiping out overnight gains and triggering a cascade of liquidations totaling $610 million. The sell-off erased 4.2% of BTC's value within 24 hours before a partial recovery to $103,000. Altcoins followed Bitcoin's downward trajectory as the broader cryptocurrency market capitalization shed $65 billion.

The dollar's strength ahead of key US inflation data release pressured risk assets, with traders scaling back expectations for Federal Reserve rate cuts. Polymarket now prices December rate cut odds at 71%, down sharply from 90% in late October. Thin liquidity conditions exacerbated price movements as clustered stop-loss orders amplified the downturn.

Derivatives markets remain particularly vulnerable to violent unwinds, repeating patterns established during October's volatility. Market participants await November 13's consumer price index data for clarity on the Fed's policy trajectory, which continues to dictate crypto asset valuations.

Hesperides University Launches World's First Master in Bitcoin Program

Hesperides University has unveiled the Master in Bitcoin, the first English-language graduate program exclusively dedicated to Bitcoin studies. Based in Las Palmas, Gran Canaria, the program marks a significant academic milestone for Bitcoin as a standalone discipline.

The curriculum breaks from traditional approaches that group Bitcoin with broader cryptocurrency or blockchain studies. Instead, it offers rigorous exploration of Bitcoin's technology, economics, and societal impact through interdisciplinary lenses including monetary theory, philosophy, and cryptography.

"Bitcoin deserves its academic space," said program director Kristýna Mazánková. "This isn't about speculation or passing trends - it's recognition of Bitcoin as both revolutionary technology and tool for human freedom."

U.S. Government Shutdown Ends, Crypto ETF Approvals Resume

President Trump has signed a funding bill to end the longest government shutdown in U.S. history, lasting six weeks. The House of Representatives passed the bill with a 222-209 vote, marking a rare bipartisan effort. Federal operations have now fully resumed, providing relief to millions of affected employees.

The shutdown had delayed critical financial legislation, including crypto ETF approvals, which had been a point of concern for digital asset markets. With government services reinstated, regulatory processes for cryptocurrency products are expected to accelerate.

Market participants anticipate renewed momentum for Bitcoin and other digital assets as institutional investment pathways reopen. The resolution removes a key uncertainty that had been weighing on crypto markets during the political gridlock.

Morgan Stanley Warns of Bitcoin 'Autumn' Phase, Advises Profit-Taking

Morgan Stanley's wealth management division has issued a cautionary note on Bitcoin, framing its current market phase as 'autumn' in a cyclical pattern reminiscent of agricultural seasons. The analysis suggests three years of bullish momentum may now give way to a corrective period.

Strategist Denny Galindo points to technical deterioration, including Bitcoin's breach of the 365-day moving average, as justification for harvesting gains. The bank's four-year market model implies institutional skepticism about near-term upside potential.

This warning comes amid stalled price recovery despite macroeconomic tailwinds, presenting a paradox for crypto investors. The report's agricultural metaphor—planting, growing, harvesting, resting—provides an unconventional framework for assessing digital asset cycles.

Bitcoin Fails To Bounce Back Post-Shutdown

Bitcoin's anticipated rally following the end of the longest U.S. government shutdown failed to materialize, contrasting sharply with its 2019 performance. The cryptocurrency has declined 12% since the shutdown began, with no immediate signs of recovery.

Regulatory paralysis at key agencies like the SEC and CFTC has stalled progress on crypto ETFs and other critical approvals. This institutional gridlock is blocking fresh capital inflows and limiting market growth potential.

Economic uncertainty and political instability continue to weigh on investor sentiment. Unlike previous cycles where Bitcoin thrived amid government dysfunction, the current environment appears to be suppressing rather than stimulating crypto markets.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market developments, Sophia provides these projections:

| Year | Price Range (USD) | Catalysts |

|---|---|---|

| 2025 | $85,000-$135,000 | ETF maturation, halving aftermath |

| 2030 | $250,000-$400,000 | Institutional adoption, scarcity premium |

| 2035 | $600,000-$1,200,000 | Global reserve asset status |

| 2040 | $1.5M-$3M+ | Full monetary network effects |

Key variables include regulatory clarity, ETF inflows, and macroeconomic conditions. The 33.98% rebound potential noted by analysts could establish $135K as the next resistance level.

border-collapse: collapse; width: 100%; margin: 20px 0;